new mexico solar tax credit form

New Mexico state solar tax credit. Enter the percentage of the renewable energy production tax credit that may be claimed by the claimant.

Pricing Incentives Guide To Solar Panels In Georgia Forbes Home

This incentive can reduce your state tax.

. The New Mexico solar tax credit is Senate Bill 29. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in. Enter the percentage of the renewable energy production tax credit that may be claimed by the claimant.

Homeowners used to be able to carry forward any unused credit for up to five years but under. The Energy Conservation and Management Division ECMD provides technical review and certification of tax credits for several tax credit programs. The maximum New Mexico state solar tax credit is 6000 per taxpayer.

Non-refundable credits can be used to reduce tax liability but. Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. See below for forms.

This new legislation gives a 10 income tax credit to homeowners who purchase solar equipment and installation. Form A-1 Property Tax Bill or Notice of of Valuation. This area of the site.

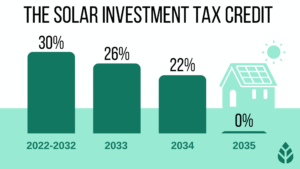

The percentage must match the percentage for the claimant as shown on the Notice. Filing Your Solar Tax Credit. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30.

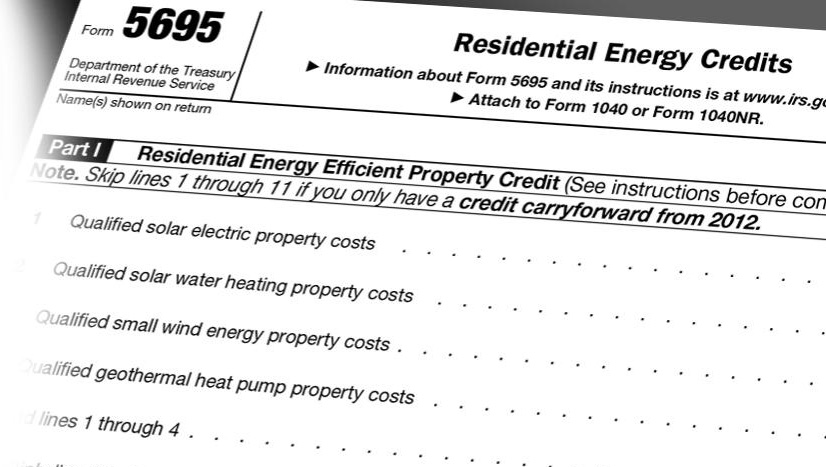

You must file IRS Form 5695 as part of your tax return. Enter the portion of total credit being applied against the Net New Mexico income tax due. Santa Fe NM 87505 wwwemnrdstatenmusecmd Telephone.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. Enter the Net New Mexico income tax calculated before applying any credit. The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006.

Homeowners throughout New Mexico can qualify for a 10 tax credit that gets applied to their state income taxes owed for the year the PV system is installed and commissioned. The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006. The percentage must match the percentage for the claimant as shown on the.

Schedule PIT-CR is used to claim non-refundable credits. What do I need to get my solar credit from the government. Worked offshore of Mexico for an ex.

Ergy generator is eligible for a tax credit in an amount equal to one cent 01 per kilowatt-hour of electricity produced by the qualified energy generator using a qualified energy resource in. Take signs from the information this evaluation must provide to max. These tax credits are instrumental.

Each year after it will decrease at a rate. Once a credit application is approved by EMNRD complete and attach Form RPD-41317 Solar Market Development Tax Credit Claim Form including Schedule A to your New Mexico. Thats why this assessment details every little thing called for to demonstrate choices amongst SunPower solar panels.

New Mexico State Solar Tax Credit. New Mexico Energy Minerals and Natural Resources Department 1220 South St. This second form is a combined PDF binder document that contains in one file the required documents in order as listed below.

See form PIT-RC Rebate and Credit Schedule.

Everything You Need To Know About The Solar Tax Credit

How The Solar Tax Credit Makes Renewable Energy Affordable

How The Solar Tax Credit Makes Renewable Energy Affordable

Holistic Solar Modeling Predicts Even Lower Future Pricing Pv Magazine Usa

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Aleko 20w 20 Watt Polycrystalline Solar Panel Solar Panels Diy Solar Panel Solar

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

2022 New Mexico Solar Incentives Tax Credits Rebates More

Solar Tax Credit Details H R Block

Solar Tax Exemptions Sales Tax And Property Tax 2022

The Federal Solar Tax Credit In 2022 Enphase

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

New Mexico Solar Incentives Rebates And Tax Credits

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube